All Categories

Featured

After registering, each bidder will certainly receive a bidding number from the Auction Internet site that will certainly allow the prospective buyer to put quotes. All bidders have to make a down payment on the Public auction Site prior to their proposals will certainly be accepted. Each bidder shall make a deposit equivalent to ten percent (10%) of the total dollar quantity of tax obligation liens the prospective buyer expects winning.

Tax obligation liens are granted to the highest bidder, or in the event of a tie, the winner will certainly be selected at arbitrary by the Public auction Website, and the winning proposal amount will certainly amount to the amount of the tie bid. Tax liens will certainly be organized right into batches and sold in one-hour increments beginning on November 6, 2024, at 8:00 a.m.

Staff members and officials of the City and County of Denver, and members of their families are not permitted to acquire at the Public Public auction - texas tax lien investing.

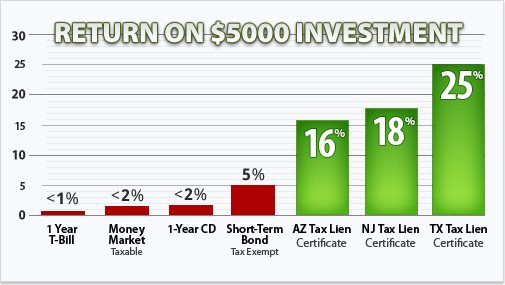

Are Tax Lien Certificates A Good Investment

There are no guarantees expressed or suggested relating to whether a tax lien will prove to be a lucrative financial investment. The building information easily accessible on the proposal pages was acquired from the Assessor's office prior to the start of the existing public auction and is for referral just (please note that this residential property info, offered by the Assessor's workplace, represents one of the most present evaluation year, not the tax year connected with this tax lien sale, as tax obligations are paid one year in arrears).

Latest Posts

Excess Sales

Homes Behind On Taxes

Tax Lien On Foreclosed Property